Australian Energy Retailers You Should Avoid

In my last blog post covered how the energy market works in Australia and why it’s impossible to get all of your energy needs met by green energy (for those on the national grid and unable to instal solar).

For those of us on the national grid, our energy comes from a mixture of renewable and non-renewable resources – who you choose as your energy retailer doesn’t change that fact.

But I also mentioned who you choose as your retailer does matter – because our choice of retailer can indirectly support the green energy market or the fossil fuel market, depending on who you go with. Considering we have limited control over how our energy is produced, the opportunity to indirectly affect the market is an important one to take up.

You can indirectly affect the market by steering away from energy retailers that have strong ties to the fossil fuel industry and moving towards those that are actively involved in or promote a green energy market. It’s a step worth taking, in my opinion.

So let’s start with those that you should move away from.

What energy retailers should you avoid?

In my last blog post, I covered things to look out for when looking for an energy retailer that supports green energy. Taking the points mentioned and flipping them, energy retailers that have these characteristics should be avoided :

- Those that own assets that generate energy from fossil fuels

- Those that do not offer carbon-neutral or GreenPower energy products

- Those that have policies and practices that encourage the consumption of energy

To determine which retailers to avoid, I focused on the first point – those that own assets that generate energy from fossil fuels. I figure, if your profits are built on the consumption of fossil fuels, then how can you be a company that truly supports green energy??

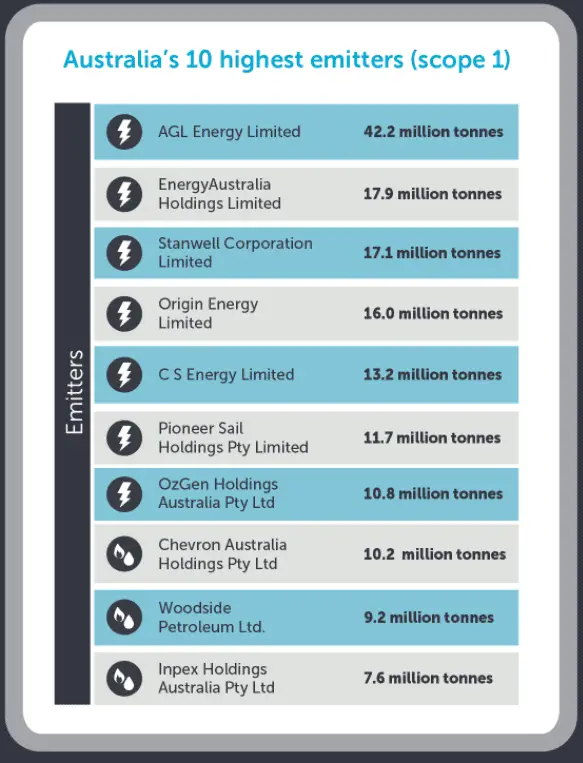

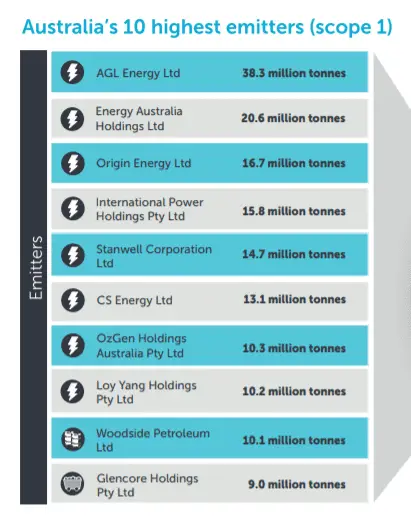

It turns out, Australia’s biggest emitters of greenhouse gases are also energy retailers – namely AGL, Energy Australia and Origin Energy. Look at the figures below from 2019/2020 (1):

(Scope 1 emissions “are direct greenhouse (GHG) emissions that occur from sources that are controlled or owned by an organisation” (3))

And if you look at the emissions in 2014/15 (which is the first time the government made these figures publically available) you can see that there hasn’t been much change in emissions since that time – in fact, AGL has managed to increase its emissions since that time! (2):

Are these companies really that bad?

Below I summarise their environmental sustainability position (as noted on their website) and offer up my opinion on this.

Energy Australia

Energy Australia recently released a climate change statement (September 2021) in which they set the following goals (10):

- “Reach net-zero greenhouse gas emissions by 2050…

- Reduce direct carbon dioxide emissions by over 60% on 2019-20 levels in 2028-2029…

- To transition out of coal assets by 2040…

- We will not build another coal-fired power station…

- We will create a net-zero transition plan and track our progress (including identifying pathways to zero Scope 1 greenhouse gas emissions by 2050)”.

On a page explaining their position on reducing emissions, there are three points (7)

- “By investing in the next generation of technology that will meet customers’ energy needs, and offsets for remaining emissions, our goal is to be carbon neutral by 2050…

- Because we need reliable and affordable energy we’re investing to make our existing power stations more efficient…

- In 2014 weak wholesale energy markets led us to close a major coal-fired power station at Wallerawang in regional New South Wales… closing the plant meant we reduced the annual carbon emissions from our generation portfolio by about 5 mega-tonnes of CO2 – the equivalent of planting 35 million trees per year…”

In a paper issued in July 2018 (9) they stated “Compared to coal and gas, renewable electricity is intermittent, meaning it is less reliable and harder to control as the sun doesn’t always shine and the wind doesn’t always blow. Renewable electricity is one piece of the energy puzzle – but more pieces, such as energy storage, are needed to deal with intermittency. The challenge is that some of these technologies remain more expensive than historic forms of generation.”

They operate 3 power stations and one mine. They currently have partial ownership of one wind farm. They also have power purchase agreements with 11 small scale renewable energy farms (9). They have increased their investments in hydroelectricity and batteries in recent times.

They offer carbon neutral products to retail customers, operating under the Australian Government’s Climate Active Carbon Neutral Standard.

My opinion: They really don’t want to tackle climate change – that was the impression I walked away with. Yes, they recently issues a policy on climate change but before this year they had no position on this, other than the commitment to being carbon neutral by 2050 (with no pathway or blueprint that shows how they would reach that goal). Their position on being net-zero by 2050 is built on the premise that they will continue to emit greenhouse gases but the emissions will be net-zero because of carbon offsets. The recent policy shift is not bad, but it doesn’t go far enough. For sure, it has not happened soon enough. Their biggest accomplishment in reducing emissions was a forced closure of a coal fire plant – not a deliberate decision on the companies part, but one that was forced by lack of demand.

Out of the three I looked at, this was by far the worst of the lot. Stay away!

Origin Energy

Since 2015 Origin Energy has been part of the “we mean business” coalition (12), focused on reporting on commitments to reduce greenhouse gas emissions (11).

They issue detailed sustainability reports each year. In the latest report, the following is noted (14):

- “An exit from coal-fired generation by 2032…

- Supply with renewables, firmed by large-scale batteries, gas-fired peaking generation and pumped hydro…

- Since 2016, we have committed to purchase the offtake from around 1,200 MW of new wind and solar projects across Victoria, Queensland and South Australia…

- Focusing on opportunities in renewable hydrogen and renewable ammonia made using renewable energy and sustainably sourced water.”

- Our fleet of gas-fired power stations will continue to play a vital role in supporting the increasing supply from renewables across the grid as, unlike coal, they can be switched on and off quickly and operated efficiently on an intermittent basis….

- We offer solar energy, renewable and carbon offset products and EV solutions, and work with our customers to develop and deliver cleaner energy solutions..

- We have been giving our customers the option to choose renewable energy products for more than 20 years (they offer GreenPower products)…

- We have long advocated for clear government policies to support Australia’s transition to a low-carbon economy and help make the transition easier for customers…”

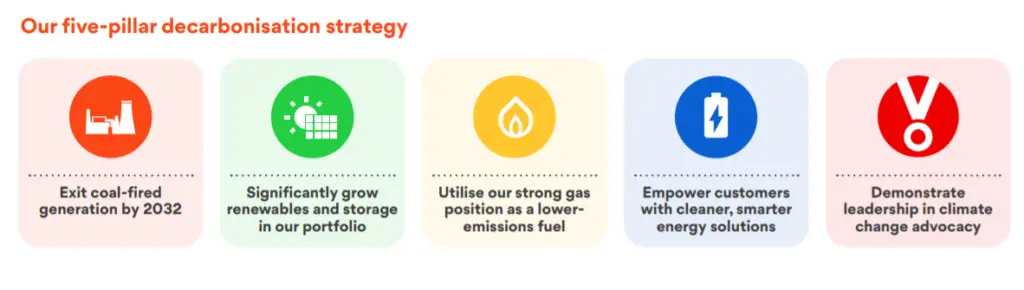

This strategy is summarised as follows (14):

On their website they have summarised key actions taken towards sustainability as follows:

- “Scope 1 and Scope 2 equity emissions down by 8% compared to FY2020…

- Progressing the update of our emissions reduction targets to a 1.5°C pathway…

- Installed 74 MW of residential and business solar installations, up from 61 MW in FY2020…

- Launched Origin 360 EV Fleet, the first full-service EV fleet management solution of its kind in Australia”

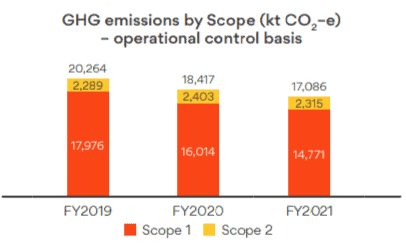

Here is a visual of the reduction of greenhouse gas emissions over the last three years (14):

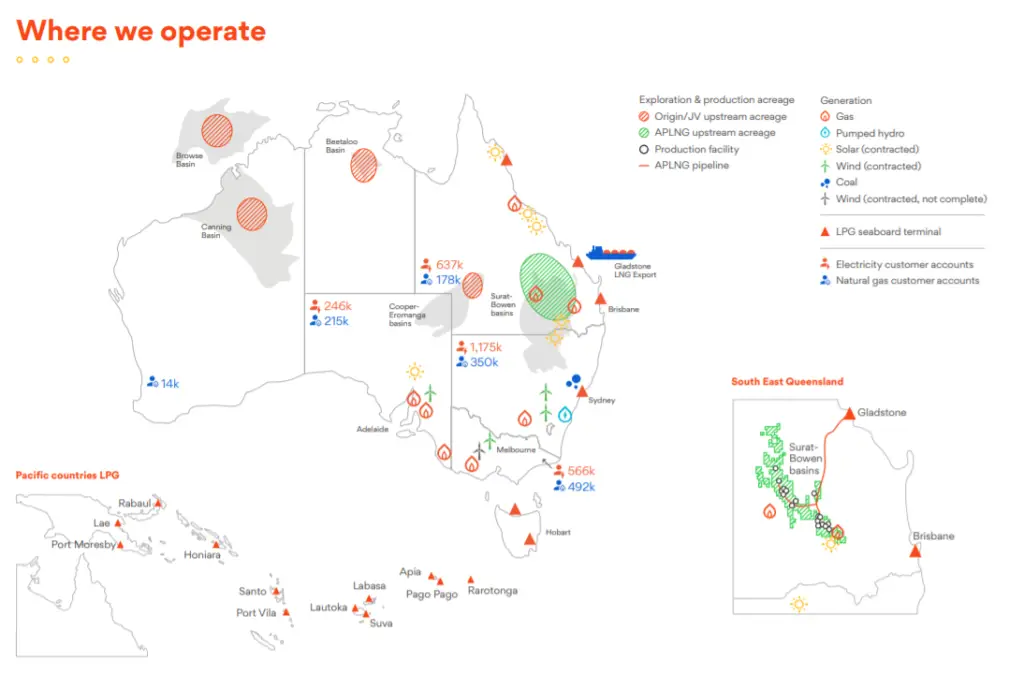

Their operations are heavily focused on gas as noted below (14):

My opinion: They go further than Energy Australia in that they have set goals since 2015 and have taken a position that actively focuses on reducing greenhouse gas emissions. However, the reduction over time is not substantial. And I think it’s easy to take the position they have regarding coal since they aren’t heavily invested in coal power generation (with only one coal power plant in their asset mix) – their main investment is gas. And this is not a renewable energy source (see more below). Origin sees gas playing an important role in helping to reduce greenhouse gas emissions. There are a lot more gas generation points in the diagram above compared to solar and wind and I think the balance is not right. I would not want to be supporting a company that is heavily invested in the gas market.

AGL

AGL has stated the following commitments in its Green House Gas policy issued in April 2015 (4):

- AGL will not build, finance or acquire new conventional coal-fired power stations in Australia

- By 2050, AGL will close all existing coal-fired power stations in its portfolio

- AGL will continue to invest in new renewable and near-zero emission technologies

- AGL will make available innovative and cost-effective solutions for our customers such as distributed renewable generation, battery storage, and demand management solutions.

- AGL will continue to be an advocate for effective long-term government policy to reduce Australia’s emissions in a manner that is consistent with the long-term interests of consumers and investors

On their website, they state: By 2050, we believe that Australia has the opportunity to be carbon neutral and an energy superpower… This will be realised by Australia generating low-cost power using zero-emissions wind and solar resources, backed up by technologies like batteries, hydropower and, for much of this transition, gas (5).

They have stated in 2020 the following commitments (6):

- “Offer customers the option of carbon-neutral prices across all our products…

- Support the evolution of Australia’s voluntary carbon markets…

- Continue investing in new sources of electricity supply…

- Responsibly transition our energy portfolio…

- Be transparent.”

A pathway towards zero emissions is mapped as follows (6):

AGL is Australia’s largest private owner and operator of renewable energy assets – they operate 2 solar power plants, 6 wind farms and 1 hydroelectricity plant. AGL also currently owns 8 coal power plants, 2 coal seam gas supplies, 2 gas storage stations, one overseas LNG import source.

A visual of their current asset ownership and where they want to be heading is shown below (6):

My opinion: Like Origin Energy, I think it’s great that they have taken a position since 2015 to reduce their greenhouse gases emissions but unlike Origin, AGL has managed to increase their greenhouse gas emissions since 2015! Also, like Origin Energy, their operations relies heavily on gas operations. I’m sure gas has its place in a future market (maybe) but the level of investment and the position taken by these companies is not something I can support.

Gas is the solution!

I wasn’t going to go into this because it’s a bigger topic, but in a nutshell, gas is also a fossil fuel. Its often argued that it is “clean” because when you burn gas it produces 50% less CO2 than burning fossil fuels. However the real damage happens when gas is extracted (true for any fossil fuel) and the most damage occurs when gas leaks occur – natural gas is made up of methane and once that is released into the air, it is 26 times more potent than CO2 releases. So in effect, gas can be just as harmful as burning coal.

Here are some websites with information on this:

Final remarks...

After reading a couple of reports and trawling through their website I can’t say I am an expert on the three companies mentioned. I am sure I have probably misread, misunderstood and plain missed many things. My opinions are formed by gaining a general sense of the companies operations by reading what is publically available. Perhaps I am off in some parts, but on the whole, I am comfortable with my conclusions.

My conclusion is this – Energy Australia was slow to come to the table. They had a chance in 2015 when the Paris accord was signed but they have stuck with the same position as the Australian government and have only recently taken a position on reducing greenhouse gas emissions. AGL and Origin have done much better, but they are not as heavily invested in coal as they rely on gas. They are unwilling to let go of that. I don’t think any of these companies have made any measurable gains in their greenhouse gas reduction targets since 2015 and that says a lot.

So currently I am with AGL. And based on what I have read to date, I won’t be staying with AGL. There are other companies out there fully committed to renewable energy, without strong ties to the gas energy market.

So I’m on the hunt for a new energy retailer. Stay tuned.

References: