Which Banks Do - and Don't - Invest in Fossil Fuels

- Does Commonwealth Bank invest in fossil fuels?

- Does ANZ invest in fossil fuels?

- Does NAB invest in fossil fuels?

- Does Suncorp invest in fossil fuels?

- Does Westpac invest in fossil fuels?

- Does the Bank of Queensland fund fossil fuels?

- Do all banks invest in fossil fuels?

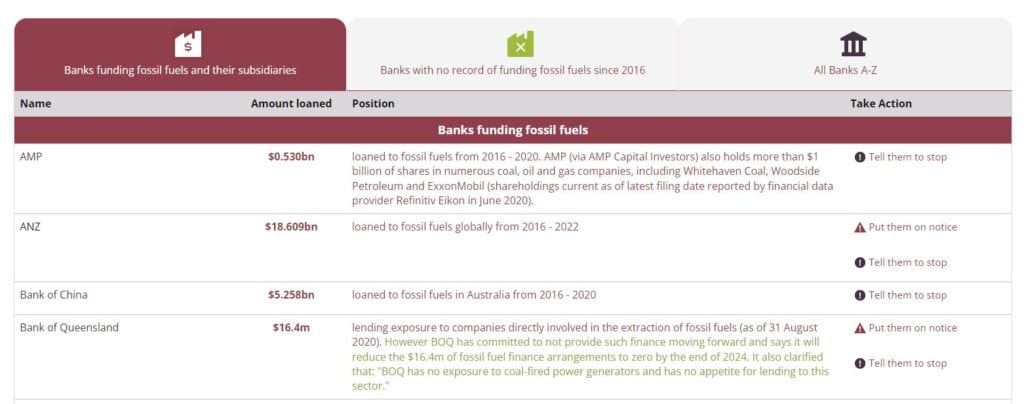

Which banks invest in fossil fuels in Australia?

- AMP

- ANZ

- Bank of China

- Bank of Queensland

- Citi Bank

- Commonwealth Bank

- HSBC

- ING

- Macquarie

- National Australia Bank

- Westpac

- 86 400 – owned by NAB

- Bank of Melbourne – owned by Westpac

- Bank SA – owned by Westpac

- Bankwest – owned by Commonwealth Bank

- ME Bank – owners by Bank of Queensland

- RAMS – owned by Westpac

- St George – owned by Westpac

- UBank – owned by NAB

Which Australian banks do not invest in fossil fuels?

And for some wacky reason, I put in that time!

I have looked into 65 of these banks and noted the savings and home loan rates these banks have to offer (as of August 2022). If you are interested, you can access this list by entering your details below.

Which banks invest in renewable energy in Australia?

Commonwealth Bank

Westpac

In 2022 Westpac invested $4.54 billion in fossil fuels.

National Australian Bank

ANZ

Macquarie Bank

- Bank Australia lends to small-scale solar installations owned by community groups or households. In addition, they have supported community energy groups like Bendigo Sustainability Group and Pingala with customer grants through the Bank Australia Impact Fund.

- Bendigo and Adelaide Bank has provided funding to several community renewable energy projects such as Hepburn Wind and Warburton Hydro.

Which Australian bank is best for climate change?

Further frequently asked questions:

Does Commonwealth Bank invest in fossil fuels?

Does ANZ invest in fossil fuels?

Does NAB invest in fossil fuels?

Does Suncorp invest in fossil fuels?

Does Westpac invest in fossil fuels?

Does the Bank of Queensland fund fossil fuels?

Do all banks invest in fossil fuels?

After more information? You may be interested in....

7 of the Best Australian Banks – For You and the Environment – there are 7 banks worth looking into if you care about the environment and key information on these is outlined here

How to Go Green in Banking and Choose the Best Bank For You – for a step-by-step process to help you choose the best green bank for you

What is Green Banking and What to Look Out For – for a definition of green, sustainable, ethical and eco-friendly banking, giving you clues into what to look out for

Green Banking – Essential Characteristics To Look Out For – outlining the characteristics of and features of green banking to look out for plus what it means to be a net zero bank

Why Green Banking Matters: Creating a Sustainable Future – if you are wondering if it is worth looking into green banking, you will find some honest answers here

Green Banking Products – Align Your Money with Your Values – for a summary of all the different green branking products out there, with links to banks that offer these

Greenwashing? The Big Four Banks and Climate Change – for information on CBA, NAB, Westpac and ANZ outlining their current position and past actions relating to climate change

Green Banks in Australia – Options Worth Considering – for information on the big four banks in Australia, four green banks in Australia and further details on Teachers Mutual

Going Green – Environmentally Friendly Banks in Australia – for further information on Bank Australia as well as CBA and Westpac, looking at their environmental policies

I like the efforts you have put in this, regards for all the great content.

Thanks for taking the time to comment Jaquan – appreciate the feedback!