How to Choose The Right Green Bank in Australia

This post was last updated in 2025

Hello there my eco-conscious warriors 😊

When taking steps to live a more sustainable and eco-conscious lifestyle, we often overlook one crucial aspect: our financial institutions.

Choosing a green bank can make a significant difference in promoting sustainable practices and mitigating climate change. Financial institutions use our money and assets to lend to others. By ensuring the bank you choose has the same values as you do, you can ensure your money is not used to harm our environment.

So in this blog post, I wanted to cover two important questions:

Under “How do you find the best green bank for you” I outline this five step process:

- Step 1: Identify banks that do not support the fossil fuel industry using Market Forces

- Step 2: Determine a short list based on price using comparison tools

- Step 3: Consider other certifications and information available

- Step 4: Conduct a final check of the shortlisted banks

- Step 5: Make your final choice and make the switch

If you want to know more, keep reading.

Let’s get into it 🚀

How do you go green in banking?

The best way to go green in banking is to bank with an organisation committed to reducing its environmental impact. These banks will offer products to help you adopt sustainable living practices and you can be ensured that the money you deposit or invest with them will not be used to harm the environment.

The most common suggestions you will find about going green in banking include:

- Go paperless – opting out of paper statements and receiving digital statements instead

- Bank online – so there is no need to travel to a branch

- Use online transfers – stop using cheques and rely on online payment transfers instead

Essentially, shift to online services wherever possible.

These suggestions make sense but I imagine many of us have already made these changes. The majority of people do utilise digital services and there are very few people that use cheques these days.

I would step it up a level and aim to find a bank that offers products and services that have minimal impact on the environment, where funding is diverted away from projects that lead to further degradation of our environment. If you want to know more about what you should be looking out in a bank check out my blog post Green Banking – Essential Characteristics To Look Out For.

If you want to know HOW to find these banks, keep reading…

How do you find the best green bank for you?

There is a wealth of information out there and different tools that can help you in your search for a green bank but what is lacking is a process to help us shift through all that information. Let me fill that gap.

Follow these 5 steps to find a green bank in Australia and make the switch:

- Step 1: Identify banks that do not support the fossil fuel industry using Market Forces

- Step 2: Determine a short list based on price using comparison tools

- Step 3: Consider other certifications and information available

- Step 4: Conduct a final check of the shortlisted banks

- Step 5: Make your final choice and make the switch

These are the steps I followed to deal with the mass of information out there and make an informed choice. And it will help to guide YOU towards a choice that is suited to your own banking needs.

Step 1: Identify banks that do not support the fossil fuel industry using Market Forces

To identify banks that do not support the fossil fuel industry you need to refer to the Market Forces website.

Market Forces is affiliated with Friends of the Earth Australia and operates as a member of the BankTrack international network, which is an international think-tank that focuses on banks and their financing activities.

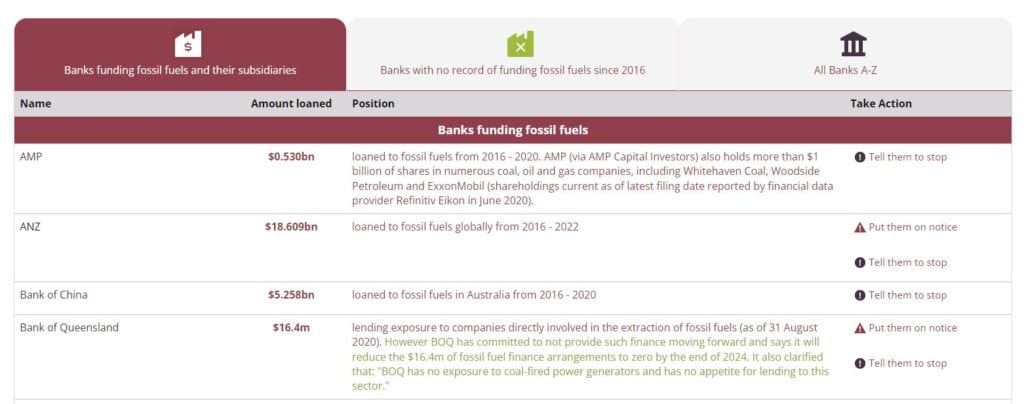

Market Forces have looked at 106 Australian banks, credit unions and building societies and gathered information on their fossil fuel investment portfolios. They have a handy table that lists all the banks that have invested in fossil fuels and those with no record of investing in fossil fuels since 2016.

Their table also notes how much money each bank invests in fossil fuel companies. What’s more, if a bank invests in fossil fuels, there is an option to send a message to these banks asking them to stop or put them on notice.

Here is a link to the table: https://www.marketforces.org.au/info/compare-bank-table

Source: Part extract from https://www.marketforces.org.au/info/compare-bank-table/#

If the bank you are currently with is listed under the “Banks funding fossil fuels and their subsidiaries” section and there is an option to put them on notice or tell them to stop, select one of these options and follow it through – Market Forces makes it easy for you to send a message to your bank, with a prepared response that you can submit. And the banks do receive these emails – I know from the responses I received from a couple of messages I sent out.

Of course, it’s not going to change the world but it is something banks are receiving and no doubt tracking. It’s so easy to do so there is no excuse!

Next, check out the “Banks with no record of funding fossil fuels since 2016” section. This is the table you will need to refer to as you move along the other steps.

What I did was copy the list of companies in this section into an Excel spreadsheet. This makes things easier as you go along the steps below.

If you are interested in having access to this spreadsheet, you are more than welcome to it. Just enter your details below and it will be sent to you (check your spam if you don’t see it in your inbox):

Step 2: Determine a short list based on price using comparison tools

There are a surprising number of institutions that do not fund fossil fuel companies and their projects. Based on data gathered in 2023, Market Forces lists 85 institutions that do not fund fossil fuel projects.

That’s awesome news! But it does make it hard to narrow down which bank you should switch to.

There are a couple of things you could look at to narrow down the list and you should follow the path that suits you. But I find looking at the interest rate from the start helps.

There are two ways you could go about this – you could go to the website of each of the banks listed and note down the interest rate offered on their website. Or you can use a comparison tool to narrow down the list.

If you are looking to save time, I would recommend using a comparison tool!

There are two websites I refer to to get pricing information for home loans:

If you are after interest rates for savings and transactional accounts, Canstar is best.

There are other comparison websites out there but they don’t list as many green banks as Canstar and Compare the Market.

This is something you do need to be aware of – by using a comparison tool, you may not be getting the full picture. There could be other cheaper eco-friendly banks out there that are not covered by the comparison websites – even if you use Canstar and Compare the Market.

But I found Canstar and Compare the Market comprehensive enough and the idea of looking up each bank and checking out their interest rates is less than appealing to me! So comparison websites are the way to go.

Follow these steps to use these websites:

- Select the relevant product type you are after (e.g. home loans or savings accounts)

- Put the details they ask for into their search tool

- Sort by the Comparison Rate for home loans or the base interest rate for savings accounts

- Go through their search results, keeping an eye out for the banks that appear on the Market Forces list.

- Pick the top five (or more, your choice!) and note down their rates.

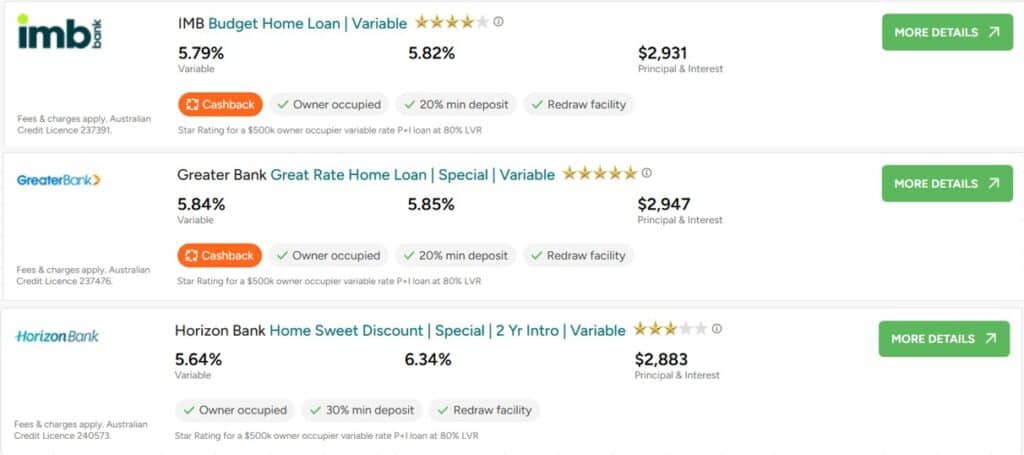

Here is a snapshot of the top 3 results using Canstar, searching for home loan rates (search conducted in August 2022):

No matter how many times I have looked this up, I have never seen any of the major banks appear on the first page of the search results.

It goes to show – it’s more economical to go with green banks!

The spreadsheet I mentioned earlier with a list of green banks also notes the best home loan rates on offer. In that spreadsheet I note:

- The top 5 – 10 banks that have the lowest home loan rate plus

- The top 5 – 10 banks that have the highest savings interest rate

To access the spreadsheet enter your details below and it will be emailed to you (check your spam if you don’t see it in your inbox):

Step 3: Consider other certifications and third-party reviews

There are a couple of sources of information you can rely on to help you narrow down your list – or at the very least use to inform your final decision.

Here are some sources of information you could rely on:

| Name | Description |

|---|---|

| Finders Green Bank of the Year | Finder (a product comparison website) awards this to retail banks based on their environmental impact and the impact of their investments. |

| B Corporation | B Corp certification is a third-party certification process that assesses companies’ social sustainability and environmental performance standards and accountability standards. |

| Global Alliance for Banking on Values (GABV) | GABV is an independent association of ‘values-based banks’ with a shared mission to use finance to deliver environmental, social, and corporate governance (ESG) positive outcomes. |

A bank that is assessed by third parties and found to tick a lot of the boxes when it comes to its environmental, social and ethical performance is a bank worth paying attention to.

Does it sound like too much to go through each of these assessment sites?

Well, of course I have gone through these myself. The spreadsheet I mentioned before also notes which institutions have received awards or have been assessed by these third-party organisations. Here’s the access one last time if you want to grab that list. No strings attached I promise – just thought I would make it available to others (check your spam if you don’t see it in your inbox):

Step 4: Conduct a final check of the shortlisted banks

Next you need to go through each of the banks in your shortlist, go to their website, check what products they have on offer and make sure the products suit your needs.

If all checks out, then give them a call to see what they can do for you.

Here are some questions to ask them when you give them a call:

- Are there any restrictions on membership/ joining the bank?

- What interest rate can you offer?

- What is the cost of switching?

The first question is important when you are looking at smaller financial institutions – some of them are open to certain sections of the population, typically based on occupation, so it pays to ask upfront. This information is not always clear on their websites.

And don’t be afraid to ask for a discounted interest rate for home loans or a bonus rate for savings and deposit accounts, as they can often offer you better than the advertised rate.

Step 5: Make your final choice and make the switch

From the previous steps, you should have the information you need to make your final choice and make the switch.

When it comes to general savings accounts, it’s a matter of going through the application process (which is generally quite easy) and transferring the money from your old bank account to the new one. Don’t forget to take steps to close your old bank account – people failing to do that is one the biggest sources of unclaimed money out there.

When it comes to home loans it’s a bit more involved. Here are some steps you will need to go through:

- You will need to go through an application process with the new bank (including getting a valuation done, which the bank will organise for you)

- Discharge papers are needed from your current bank and you need to change the mortgagee details on your house insurance, before the settlement date.

- You need to make sure those discharge papers are completed in full before settlement.

- Then you need to make sure both sides agree on a settlement date.

- Then make sure you check in close to settlement date to ensure settlement is on track

and that’s it. Except to add, you may need to reset any direct debits and your income deposits, if that is how you are going to use your home loan and related transaction accounts.

So it’s a bit of work! But if you are getting a lower rate it is well worth it. And your money is no longer used to finance fossil fuel projects, which is just about everything because it is through these conscious choices we can collectively work towards a more sustainable future 🌎

xxx Tahsin

After more information? You may be interested in….

7 of the Best Australian Banks – For You and the Environment – there are 7 banks worth looking into if you care about the environment and key information on these is outlined here

What is Green Banking and What to Look Out For – for a definition of green, sustainable, ethical and eco-friendly banking, giving you clues into what to look out for

Green Banking – Essential Characteristics To Look Out For – outlining the characteristics of and features of green banking to look out for plus what it means to be a net zero bank

Why Green Banking Matters: Creating a Sustainable Future – if you are wondering if it is worth looking into green banking, you will find some honest answers here

Green Banking Products – Align Your Money with Your Values – for a summary of all the different green branking products out there, with links to banks that offer these

Which Banks Do – and Don’t – Invest in Fossil Fuels – for a summary of which Australian banks do and don’t invest in fossil fuels and those that do invest in renewable energy

Greenwashing? The Big Four Banks and Climate Change – for information on CBA, NAB, Westpac and ANZ outlining their current position and past actions relating to climate change

Green Banks in Australia – Options Worth Considering – for information on the big four banks in Australia, four green banks in Australia and further details on Teachers Mutual

Going Green – Environmentally Friendly Banks in Australia – for further information on Bank Australia as well as CBA and Westpac, looking at their environmental policies

A Heads Up: This post may contain affiliate links that earn me a small commission at no additional cost to you. Also as an Amazon Associate, I earn from qualifying purchases. I only recommend products and services that will help you take steps towards a more sustainable life and will not recommend anything that does not align, in some way, with these values.