Greenwashing?

The Big Four Banks and Climate Change

- Operational emissions – reducing emissions relating to operating their business

- Green banking products – products that encourage sustainable living practices

- Funding sustainable initiatives – financing given to projects or companies engaged in sustainable activities, including clean energy production

- Financing emissions – reducing emissions relating to lending practices

Is Commonwealth Bank a green bank?

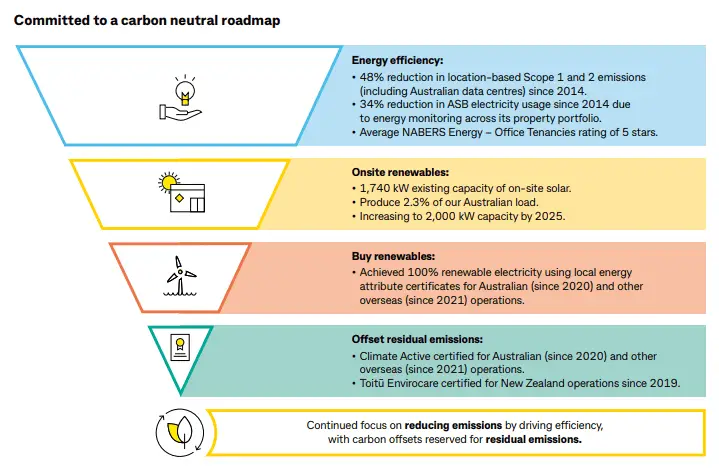

- CBA has set a 42% reduction target for Scope 1 and 2 emissions (compared to the 2020 baseline)

- They are one of two banks to set a Scope 3 emissions reduction target at 25% (against the 2020 baseline)

- They are committed to ensuring 100 % of energy is sourced from renewables by 2030

- They are the only big bank to set an on-site renewable energy target of 2000 kW by 2025

- Where possible, they will lease new main commercial office spaces, and build new retail branches with a minimum 5-star Green Star rating

- They will maintain the operational performance of all main commercial spaces to a minimum weighted average of 4.5 stars as predefined by NABERS Tenancy Energy or its international equivalent

- They will transition over time to hybrid and battery-powered business-related motor vehicles

- CommBank Green Loan – a 10-year secured fixed rate loan designed for existing, eligible home loan customers to buy and install clean energy products such as solar panels, battery packs and solar hot water systems.

- CommBank Green Home Offer – rewards eligible customers with access to a low standard variable rate if their home meets certain sustainability and energy efficient criteria

- CommBank Personal loan discount – lower interest rates for eligible sustainable purchases

- CBA has committed to providing no project finance to new or expanded Thermal Coal Mines and new coal-fired power plants

- They will reduce their existing project finance exposure to Thermal Coal Mines and coal-fired power plants to zero by 2030

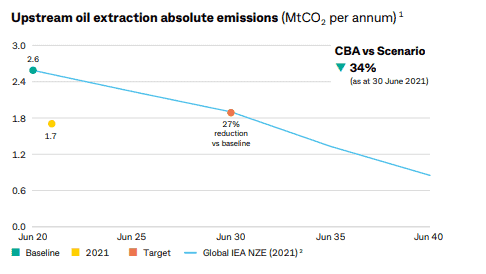

- Financing of upstream oil extraction will be reduced by 27% from a 2020 baseline

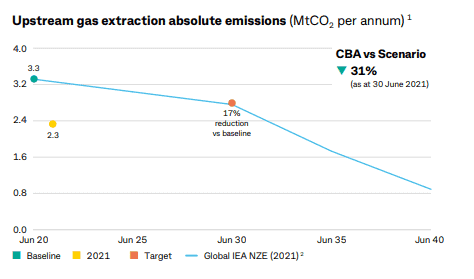

- Financing of upstream gas extraction will be reduced by 17% from a 2020 baseline

- Emissions from power generation will be capped to 405 kg CO2/MWh

- They will only provide project finance for new or expanded oil or gas projects or Metallurgical Coal Mines after an assessment of the environmental, social and economic impacts of such activity, and if in line with the goals of the Paris Agreement

- They will only provide corporate or trade finance to new clients in oil and/or gas producing, metallurgical coal mining or coal-fired power generation, who have publicly committed to the goals of the Paris Agreement, and after an assessment of the environmental, social and economic impacts

- They will not provide corporate or trade finance to new clients who derive 25% or more of their revenue from the sale of thermal coal

- They will reduce corporate and trade finance exposure to existing clients who derive 25% or more of their revenue from the sale of thermal coal to zero by 2030 and

- They will only offer corporate or trade finance to existing clients in oil and/or gas producing, metallurgical coal mining or coal-fired power generation, after an assessment of the environmental, social and economic impacts. From 2025, they expect these clients to have published transition plans

So this is all good stuff right??

Some specific details Market Forces note on their website:

- CBA co-arranged a US$1 billion loan to Santos in August 2022.

- They co-arranged a $16.7 billion loan for Australia’s biggest coal producer, Glencore

Is NAB a green bank?

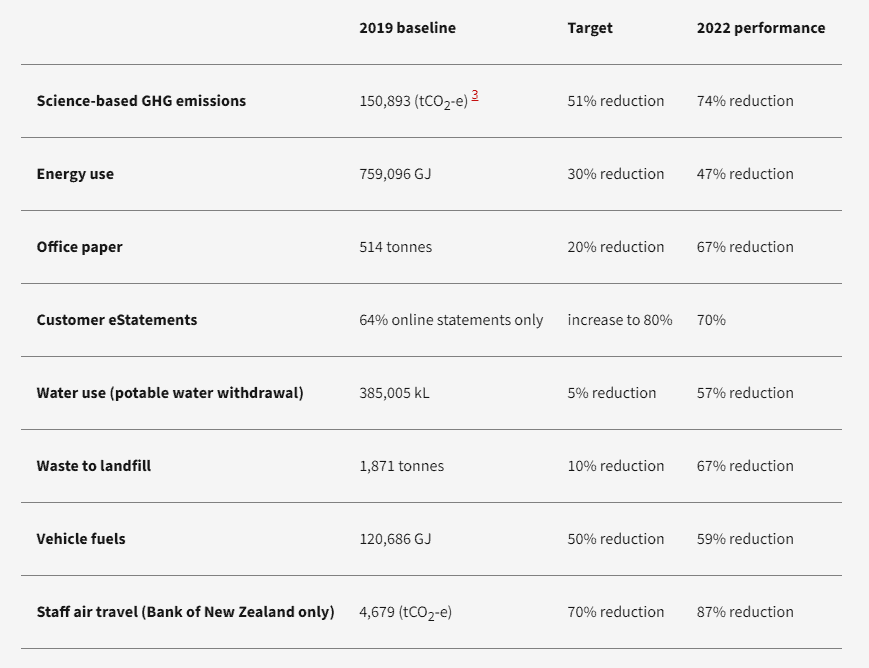

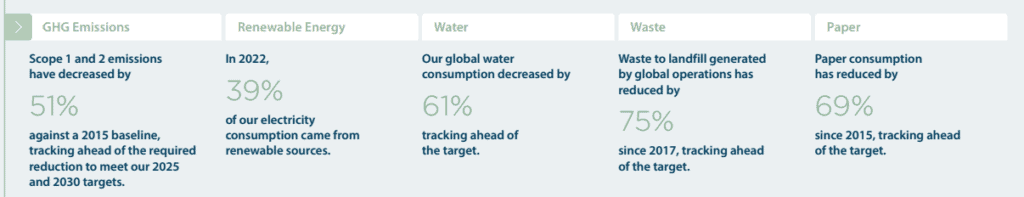

- reduce Scope 1 & 2 greenhouse gas emissions (GHG) by at least 51% from 2015 levels.

- source 100% of electricity consumption from renewable sources

- Sustainable Home Discount Offer – an interest rate discount to eligible customers on eligible home loans and a 5% discount on the cost of Lenders’ Mortgage Insurance when purchasing an eligible green property.

- Responsible investing advice – NAB connects individuals and families with specialist advisers from JBWere, one of Australia and New Zealand’s leading private wealth managers focused on responsible investing.

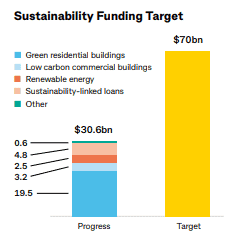

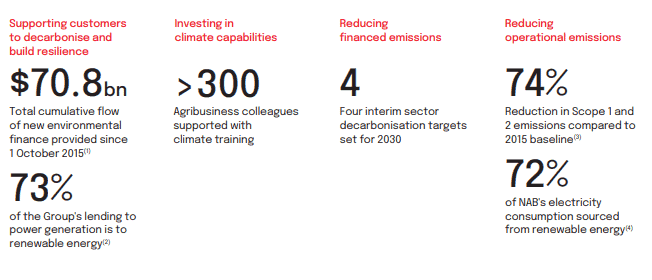

- $40.7 billion to support green infrastructure, capital markets and asset finance.

- $30.1 billion in new mortgage lending flow for new dwellings and significant renovations for 6 Star residential housing in Australia.

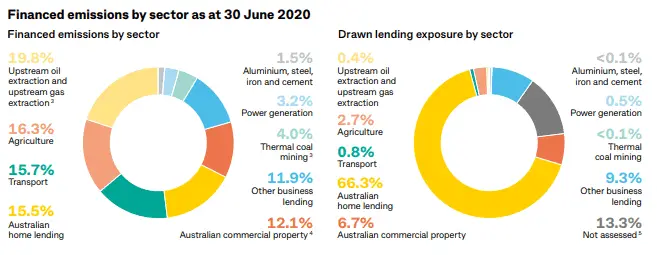

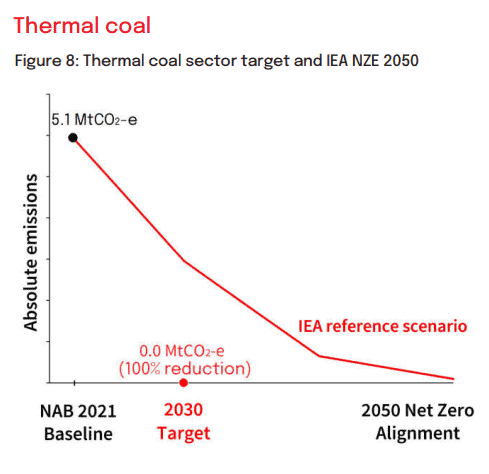

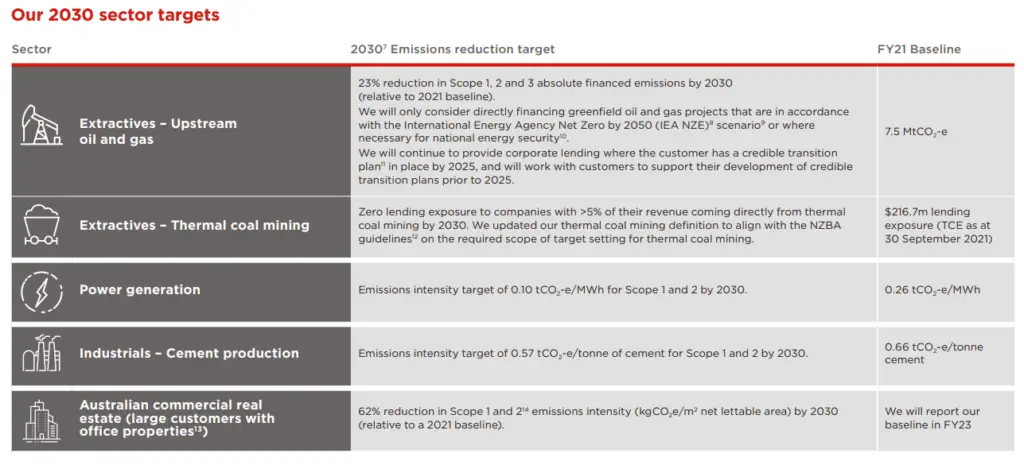

- Thermal coal – a 100% decrease in absolute emissions by 2030, against a 2021 baseline.

- Power generation – a 32% decrease in emissions intensity by 2030, against a 2021 baseline.

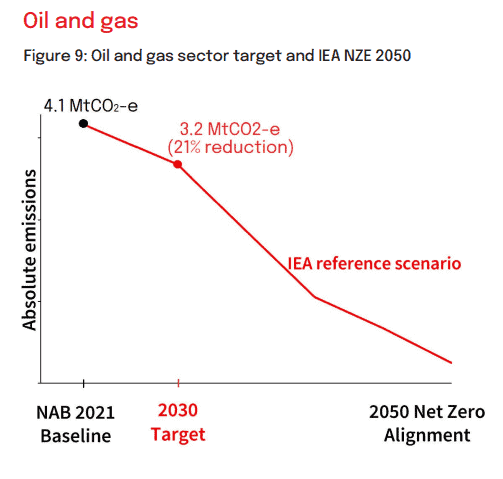

- Oil and gas – a 21% decrease in absolute emissions to 3.2 MtCO2-e by 2030, against a 2021 baseline.

- Cement – a 24% decrease in emissions intensity by 2030, against a 2021 baseline.

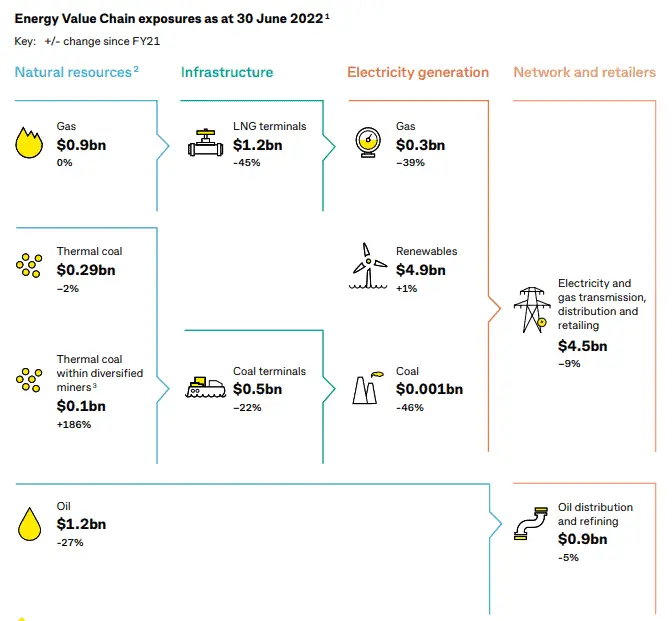

- Exposure to coal-fired power generation has reduced to zero

- Thermal coal mining exposure decreased to $0.42 billion (2022) from $0.52 billion (2021)

- Power generation exposure increased slightly to $7.36 billion (2022) from $7.18 billion (2021).

- Oil and gas exposure increased from $2.90 billion (30 September 2021) to $3.60 billion (30 September 2022).

- Oil and gas exposure (lending only) decreased to USD0.99 billion (30 September 2022) from USD1.53 billion (30 September 2021). NAB discloses its oil and gas lending exposures in USD as the majority of its lending is denominated in that currency.

So the not so great news...

- Market Forces calculated NAB increased their exposure to fossil fuels by 11% in 2022, with the increases primarily attributed to oil and gas extraction. Based on the figures noted above, funding for oil and gas expansion increased by 24%!

- NAB explained the increase was “significantly driven by passive movements in foreign exchange positions across the existing portfolio and is not due to an increase in underlying lending.” Market Forces did not buy that excuse, arguing that NAB needs to work to reduce its exposure to the sector and minimise the risk of currency movements blowing out its target.

- NAB has the lowest oil and gas emission reduction targets of all the big four banks and their reduction targets are based on a 2015 baseline. The emissions in 2015 are substantially higher than the later years, so the end result will be emission amounts that are potentially higher than any other bank (other than ANZ who also based their targets against a 2015 baseline)

- NAB has recommitted itself to LNG investments stating “NAB will continue to support integrated liquified natural gas (LNG) in Australia, New Zealand, and Papua New Guinea and selected LNG infrastructure in other regions.”

- In line with this policy, NAB participated in a loan facilitating the Pluto 2 LNG project, which will process gas from Woodside’s Scarborough gas field. Lifetime emissions from the Scarborough-Pluto project would be 1.6 billion tonnes of CO2, equivalent to 15 coal-fired power stations running for 30 years.

- While NAB will not provide project-based funding to the thermal coal industry, the door is still open to provide corporate finance to these companies. For example, NAB is still exposed to Whitehaven Coal with a loan due to reach maturity in 2023. This is a problem as, globally, corporate finance accounts for nearly 80% of the finance underpinning new coal production, dwarfing direct project finance.

Is Westpac a green bank?

- Westpac’s target for operational Scope 1 and 2 emissions reduction is 64% by 2025 and 76% by 2030, relative to a 2021 baseline.

- Their target for Scope 3 supply chain emissions reduction is 50% by 2030 relative to a 2021 baseline.

- They aim to source 100% of global electricity consumption from renewable sources by 2025.

- They also aim to transition their Australian and New Zealand vehicle fleet to 100% electric or plug-in hybrid vehicles by 2030.

Green banking products

- Sustainability-linked loans where loan pricing is tied to the sustainability performance of the company

- Green Tailored Deposits which allow customers to invest funds with Westpac to support the transition to a low-carbon economy.

So what's wrong with all that...

-

Westpac’s target to reduce the emissions intensity of its power generation customers to 0.10tCO2e/MWh (tonnes of carbon dioxide equivalent per megawatt-hour) by 2030 would mean net zero won’t be reached until 2070.

-

The bank’s commitment to reduce upstream oil and gas project finance emissions by 23% by 2030 falls short of the emission reductions in the International Energy Agency’s Net Zero by 2050 scenario (NZE), which requires combined oil and gas emissions to fall by 28% from 2019-2030.

-

Westpac says it will consider directly financing new greenfield oil and gas projects that are in line with the NZE, even though this scenario explicitly rules out new oil and gas field developments.

-

The policy offers a loophole for projects where the Australian or New Zealand Government or regulators determine that supply from the asset is necessary for national energy security. This means Westpac’s apparent climate change commitment can effectively be overruled at any time by the government of the day.

-

Westpac’s expectation that customers will have developed credible transition plans by 2025 gives clients like Whitehaven Coal, Woodside and Santos three more years to open up new coal, oil and gas projects that are incompatible with the Paris Agreement and could operate for decades.

- In 2022 Westpac refinanced loans with Woodside. Woodside has several LNG expansion projects planned such as Scarborough off the coast of Western Australia and Sangomar off the Senegalese coast. Woodside also bought BHP’s petroleum business earlier this year, adding several other expansionary oil and gas projects to its books.

- Westpac also lends to Whitehaven Coal, which is planning to spend $2 billion on expansionary coal mining projects such as Vickery, Winchester South and Narrabri Stage 3. These projects will produce an estimated 1.14 billion tonnes collectively.

- Westpac is also party to a $1 billion loan to Santos in August 2022. Santos is currently pursuing multiple new oil and gas projects including the Narrabri gas project, the Pikka oil project, and the Barossa LNG project.

Is ANZ a green bank?

- Reduce Scope 1 and 2 operational emissions by 85% by 2025 and to 90% by 2030 (against a 2015 base year)

- reduce water consumption by 40% against a 2017 baseline

- reduce waste to landfill by 40% against a 2017 baseline

- reduce paper consumption by 70% against a 2015 baseline

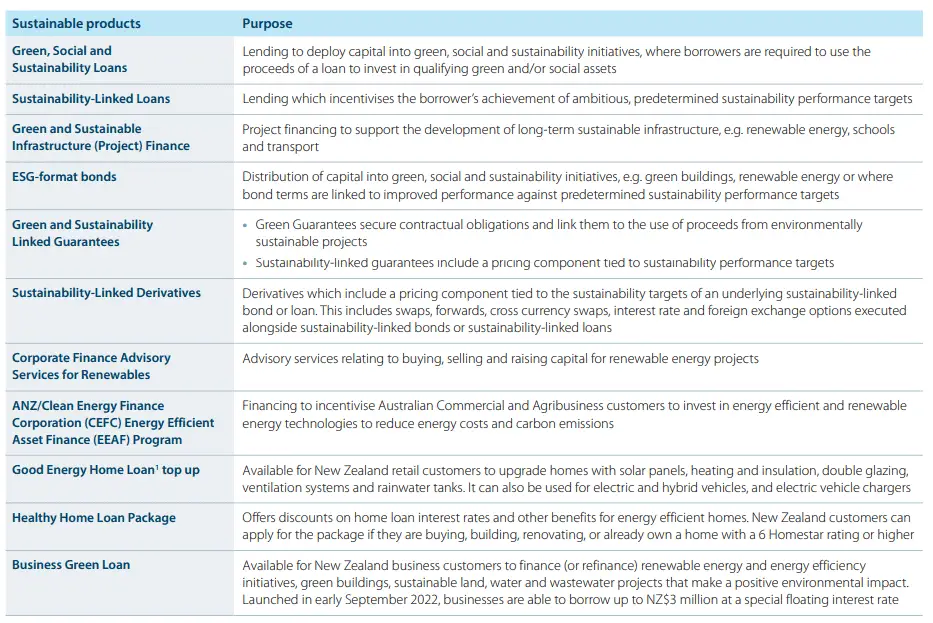

Green banking products

Financing emissions

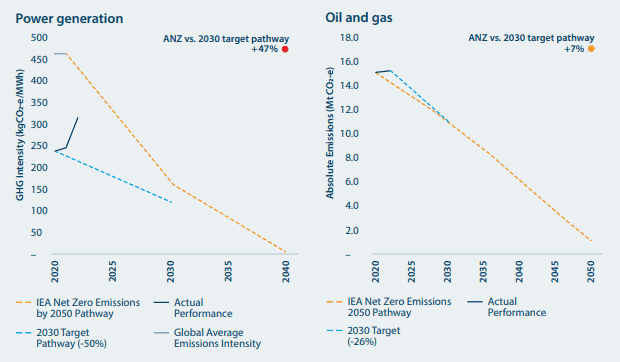

So how does this all stack up...

- From 2016 to 2020 ANZ has invested close to $14 billion in the fossil fuels industry

- Since 2021 ANZ has been involved in at least 33 more fossil fuel deals, including 18 for companies with expansionary plans and 4 direct project finance deals for new or expanded fossil fuel projects

- ANZ has signed off on deals for Santos, Viva Energy, Woodside, China Gas, Cooper Energy and Horizon Oil.

- ANZ also provided finance for the Pluto 2 LNG project in March 2022 which will process gas from Woodside’s Scarborough gas field and emit an estimated 1.37 billion tonnes of CO2 into the atmosphere.

- ANZ co-arranged a $1 billion loan to Santos in August 2022. Santos is currently pursuing multiple new oil and gas projects including the Narrabri gas project, the Pikka oil project, and the Barossa gas project.

Are the big four banks greenwashing?

And yet the banks have not taken steps in this direction.

Here is a depressing round-up of how much the big four banks have put into the fossil industry, and continue to pour into this industry (taken from the scorecards prepared by Market Forces):

- $8.9 billion to the dirty coal, oil and gas industry, up 18% since 2019, bringing the total amount loaned since 2016 to $44.4 billion,

- $835 million for projects that expand the fossil fuel industry, enabling an additional 1.1 billion tonnes of CO2to to be released into our atmosphere, and

- $1.3 billion to major Australian fossil fuel companies pursuing plans consistent with the failure of the Paris Agreement, including $464 million to some of the most climate-destructive companies in Australia; Whitehaven Coal and Santos.

Taking a more holistic view, Catalyst, a non-profit research company, looked into the very question of whether the four Australian banks are greenwashing.

They conducted an in-depth study looking into the claims these banks make to uphold social and environmental performance standards and the actions these banks take in their lending behaviour. And they found the two often did not match. In their words:

An overview of the social and environmental performance of Australian and international banks using commonly accepted sustainability indicators reveals a schism exists between symbolic and substantive sustainability efforts.

After more information? You may be interested in....

7 of the Best Australian Banks – For You and the Environment – there are 7 banks worth looking into if you care about the environment and key information on these is outlined here

How to Go Green in Banking and Choose the Best Bank For You – for a step-by-step process to help you choose the best green bank for you

What is Green Banking and What to Look Out For – for a definition of green, sustainable, ethical and eco-friendly banking, giving you clues into what to look out for

Green Banking – Essential Characteristics To Look Out For – outlining the characteristics of and features of green banking to look out for plus what it means to be a net zero bank

Why Green Banking Matters: Creating a Sustainable Future – if you are wondering if it is worth looking into green banking, you will find some honest answers here

Green Banking Products – Align Your Money with Your Values – for a summary of all the different green branking products out there, with links to banks that offer these

Which Banks Do – and Don’t – Invest in Fossil Fuels – for a summary of which Australian banks do and don’t invest in fossil fuels and those that do invest in renewable energy

Green Banks in Australia – Options Worth Considering – for information on the big four banks in Australia, four green banks in Australia and further details on Teachers Mutual

Going Green – Environmentally Friendly Banks in Australia – for further information on Bank Australia as well as CBA and Westpac, looking at their environmental policies