Why Green Banking Matters - Creating a Sustainable Future

This post was last updated in 2023

What are the benefits of green banking?

- Conducting themselves in a way that reduces emissions, minimises waste and improves efficiency in the use of natural resources

- Offering products and services that minimise waste and/or have a low carbon footprint

- Divesting away from activities that contribute towards climate change or negatively impact our natural resources

- Investing in activities that mitigate climate change and encourage efficient use of our natural resources

- Less virgin forests are being consumed with the move to online/ digital services

- Less carbon is produced when banks shift to using energy-efficient office equipment

- Less landfill waste produced in offices that encourage recycling and reuse

- Reduction in operational costs for banks that use less office stationery, energy and water

- Direct economic support is given to smaller “green” businesses when they are favoured in procurement processes

- Investment in green solutions: Green banks tend to invest in clean energy projects, industries, and products that matter. Electric vehicles, smart power grids, and renewable energy systems are some of the seemingly risky innovations that green banks usually invest in.

- Ability to up-scale new technologies: By focusing funding on environmentally friendly technologies, the private sector has the assurance that funding will be provided and this encourages further development in this sector. This allows for these activities to be upscaled and developed at a rapid pace.

- Reduced investment in environmentally damaging activities: Green banks, in general, do not finance damaging sectors of our economy like the fossil fuel industry, thereby limiting their activities

- Key environmental issues are addressed: By increasing the amount of investment in green solutions and decreasing the financing of environmentally damaging companies, green banks are indirectly addressing key environmental issues.

- Lower Energy Costs: Green bank financing helps implement clean energy solutions that can lower energy bills for consumers and businesses with no upfront cost

- Economic Development and Job Creation: Environmental-friendly projects supported by green banks are generally local projects. This provides a boost to the local economy and local job creation

- Increased customer awareness: Green banking activities assist in developing customers’ environmental consciousness

- Increased awareness in the banking sector: Through their practices, green banks create awareness in the banking sector around environmentally and socially responsible business practices

- Stronger governance structures: Several green banks publish their financial reports annually to inform investors and customers about investments they’ve made and the carbon emissions they’ve produced. This culture of climate accountability encourages other banks to establish strong governance structures that are responsive to climate trends.

- Setting new standards: Green banks adopt environmental standards that lead the way for other institutions, benefiting future generations.

- reduction in long-term costs and expenses,

- tax advantages

- higher profits for banks in the long term

- improvement in customer goodwill

- promotion of banks’ reputation

- Physical risk – which arises from climate and weather-related events, such as floods, storms, heatwaves, droughts and sea-level rise and its impacts on humans and natural systems. Physical risks can lead to higher credit risks and financial losses by impairing asset values.

- Transition risks – are those that can arise while adjusting, frequently in a disorderly fashion, towards a low-carbon economy. The paper notes “Given that climate change mitigation actions often require radical changes and adjustments by the public and private sector and households, a large range of assets are at risk of becoming stranded. This is especially prevalent for fossil-fuel related sectors and assets, which as a result of a revaluation, can in turn lead to higher credit exposure for banking and non-banking financial institutions.”

- Liability risks – this can arise if parties suffering losses from the damages of climate change seek compensation from those they hold accountable.

What are the disadvantages of green banking?

- high costs and long payback periods with eco-friendly projects

- customers’ insufficient knowledge regarding green banking

- technical obstacles

- lack of capable and well-trained staff in appraising green credits

- difficulties and complexity in assessing eco-friendly projects

- diversification issues and credit risks

- reduction in banks’ competitiveness in the short term

- operational self-insufficiency

- low demand for eco-friendly projects.

- Reputational Risk: If green banks are involved in projects which are damaging the environment, it is more damaging to their reputation compared to traditional banks that do not promote themselves as being green

- Diversification Problem: Since business transactions are restricted by a more stringent screening process, green banks have a limited number of customers and therefore a smaller base to support their operations

- Start-up phase: Many green banks are new institutions and it generally takes 3 to 4 years for a bank to start making money.

- High operating cost: Green banks require talented and experienced staff, experienced in green banking practices

- Lack of government support

- Less enthusiasm from the bank sector

Why is green banking important?

By doing so, it has been argued that green banks are key to helping us achieve a number of the UNs sustainable development goals:

- Goal No. 7 affordable and clean energy;

- Goal No. 9 industry, innovation, and infrastructure

- Goal No. 11 sustainable cities and communities

- Goal No. 12 responsible consumption and production; and

- Goal No. 13 climate actions.

What is the importance of green banking in addressing global warming?

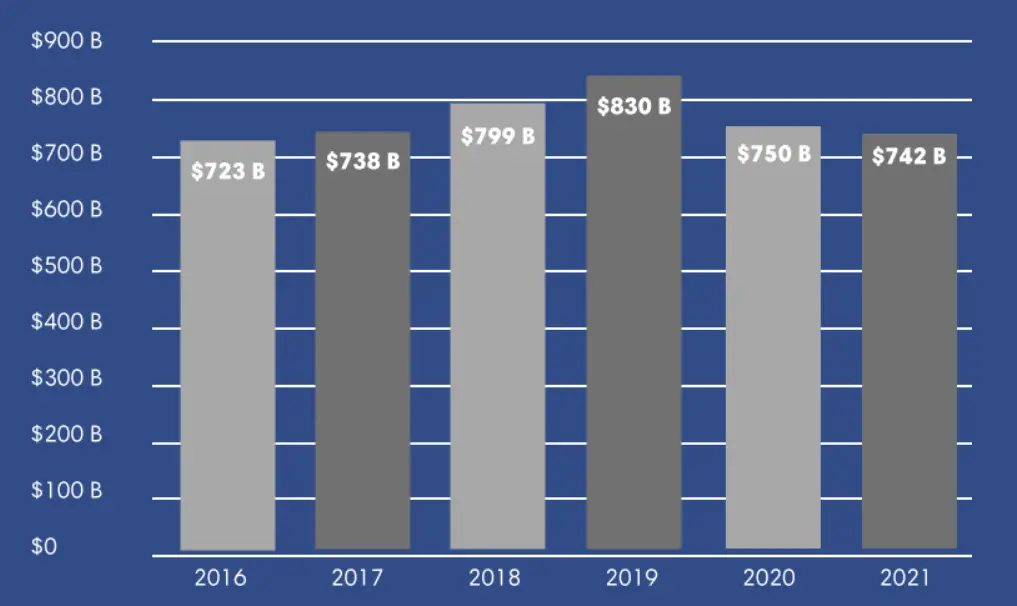

Their graph shows that more than 4.5 trillion dollars have gone to fossil fuel companies thanks to the banking sector.

And as noted in the previous section, these shifts are happening. And we can do our part by actively supporting institutions that encourage this behaviour.

xxx Tahsin

After more information? You may be interested in....

7 of the Best Australian Banks – For You and the Environment – there are 7 banks worth looking into if you care about the environment and key information on these is outlined here

How to Go Green in Banking and Choose the Best Bank For You – for a step-by-step process to help you choose the best green bank for you

What is Green Banking and What to Look Out For – for a definition of green, sustainable, ethical and eco-friendly banking, giving you clues into what to look out for

Green Banking – Essential Characteristics To Look Out For – outlining the characteristics of and features of green banking to look out for plus what it means to be a net zero bank

Green Banking Products – Align Your Money with Your Values – for a summary of all the different green branking products out there, with links to banks that offer these

Which Banks Do – and Don’t – Invest in Fossil Fuels – for a summary of which Australian banks do and don’t invest in fossil fuels and those that do invest in renewable energy

Greenwashing? The Big Four Banks and Climate Change – for information on CBA, NAB, Westpac and ANZ outlining their current position and past actions relating to climate change

Green Banks in Australia – Options Worth Considering – for information on the big four banks in Australia, four green banks in Australia and further details on Teachers Mutual

Going Green – Environmentally Friendly Banks in Australia – for further information on Bank Australia as well as CBA and Westpac, looking at their environmental policies