What is Green Banking and What to Look Out For

In this blog post, I have gathered information from various research papers and financial institutions to delve into this further and address the following questions:

This information will help you understand the different terms out there and allow you to set your own expectations on what a green bank should offer.

What is green banking?

Naturally, green banks can vary in the extent they consider these aspects.

- People’s Bank of China: Policy and institutional arrangements that attract private capital investment into green industries

- Government of Germany: An approach focused on the move towards low-carbon and resource-efficient economies

- Indonesian Financial Services Authority: Support from the finance industry to achieve sustainable development

- Organisation for Economic Co-operation and Development (OECD): Supports economic growth while reducing emissions, minimising waste and improving efficiency in the use of natural resources

- Swiss Federal Ministry of Environment: Responsible investment which creates a positive environmental, social and governance impact

- Banks can help environment through automation and online banking.

- Green banking focuses on social safety and security through changing the negative impacts of the society.

- In financing, it always gives priority to investments / loans which consider risk factors regarding environmental conditions.

- It always cares for sustainable and green growth in industrialisation and for social purposes.

- It creates a congenial atmosphere inside and outside the bank.

- It considers the clients as its family members, and as such, guide and supervise the projects to reduce pollution and thus implement scientific methods in the real sense by implementing environmental due diligence (EDD) checklist.

- It reduces cost and energy, thus saving money and increasing GDP of a country.

- It changes the mental faculties of the officials and customers, in line with green sensibilities.

- It helps institutions, men and the nation in general live with dignity.

Functional, banks can do this by:

- Conducting themselves in a way that reduces emissions, minimises waste and improves efficiency in the use of natural resources

- Offering products and services that minimise waste and/or have a low carbon footprint

- Divesting away from activities that contribute towards climate change or negatively impact our natural resources

- Investing in activities that mitigate climate change and encourage efficient use of our natural resources

Where that money goes matters.

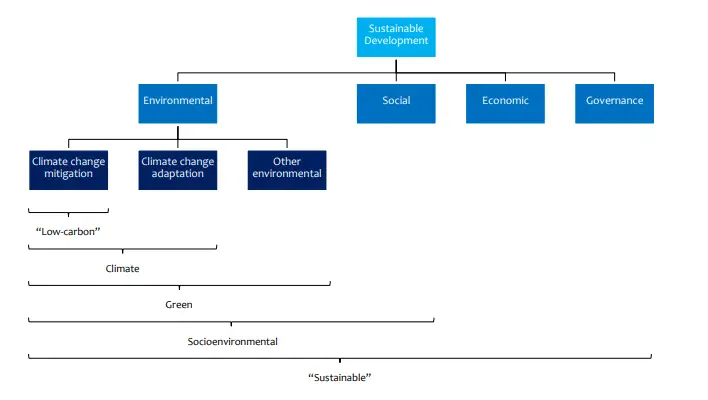

What is the difference between green banking, eco-friendly banking, sustainable banking and ethical banking?

- Environmental refers to the quality and functioning of the natural environment and natural systems

- Social refers to the rights, well-being and interests of people and communities

- Governance deals with the relationship between the company’s management, its board, its shareholders and other stakeholders and how that is managed.

- Economic refers to impacts on economic conditions at local, national, and global levels.

This provides more context around the terms environmental, social and governance.

The “economic” element of sustainable finance requires little explanation as it covers the more traditional elements that banks focus on – that being a focus on economic growth and profitability. And this is an essential element in sustainable development.

As stated by the UK Government in 2001:

- Eco-Friendly Banks are Paperless

- Eco-Friendly Banks are Transparent

- Eco-Friendly Banks are Energy Efficient

- Eco-Friendly Banks Support Sustainable Causes

Ethical banking is a fairly broad term used to describe banks that operate around a set of principles and ideals that are used to govern how they interact with their clients, their community, and the world in general.

These principles are generally designed to promote social equity and sustainable development. As noted by Banktrack: “…ethical banks’ believe that profitability should not only be measured in financial terms, but also in social terms”.

Often you find that banks that are considered highly ethical, do not invest their money in the following activities:

- Deforestation

- Tobacco companies

- Human Exploitations

- Gambling

- Pornography or sex slave trade

- Animal cruelty

- Weapons (including guns or other arms)

- Fossil fuels and mining of precious minerals

But of note, some of the concerns for ethical banks can overlap with those that green banks focus on – such as deforestation, fossil fuels and mining of precious minerals.

This is why, on the whole, you will find all these terms – green, sustainable, eco-friendly and ethical – used interchangeably.

What is a green bank in Australia and what should I look out for?

So yep, let me give you another definition of “green banking” to consider.

Another way of defining a “green bank” is to narrowly define it as an institution that lends money to climate mitigation and adaptation strategies. This is a definition that seems to be relevant when looking at green banking in Australia.

The Clean Energy Finance Corporation is one of only a handful of national green banks in OECD countries. Its main purpose is to help scale up investment in clean energy projects, thereby contributing to Australia’s transition to a low-carbon economy. The Corporation has helped overcome barriers to private investment in low-emission solutions and cleantech.

Green Banks are mission-driven financial firms that utilize innovative finance to speed the transition to sustainable energy and combat climate change. They are mission-driven, which means they care more about installing renewable energy than making a profit. They are continually developing a pipeline of clean projects and looking for market prospects.

The unfortunate thing is that there are no clear standards around this. However, there are some measures out there that you can rely on – whether that be looking at how much a bank invests in fossil fuels projects to awards that have assessed a bank’s commitment to protecting the environment. And its something worth looking into.

After more information? You may be interested in....

7 of the Best Australian Banks – For You and the Environment – there are 7 banks worth looking into if you care about the environment and key information on these is outlined here

How to Go Green in Banking and Choose the Best Bank For You – for a step-by-step process to help you choose the best green bank for you

Green Banking – Essential Characteristics To Look Out For – outlining the characteristics of and features of green banking to look out for plus what it means to be a net zero bank

Why Green Banking Matters: Creating a Sustainable Future – if you are wondering if it is worth looking into green banking, you will find some honest answers here

Green Banking Products – Align Your Money with Your Values – for a summary of all the different green branking products out there, with links to banks that offer these

Which Banks Do – and Don’t – Invest in Fossil Fuels – for a summary of which Australian banks do and don’t invest in fossil fuels and those that do invest in renewable energy

Greenwashing? The Big Four Banks and Climate Change – for information on CBA, NAB, Westpac and ANZ outlining their current position and past actions relating to climate change

Green Banks in Australia – Options Worth Considering – for information on the big four banks in Australia, four green banks in Australia and further details on Teachers Mutual

Going Green – Environmentally Friendly Banks in Australia – for further information on Bank Australia as well as CBA and Westpac, looking at their environmental policies